Payroll Guide to Hiring Seasonal Workers

If you’re setting up a business which relies on seasonal trade, you’ll be looking to hire seasonal workers during peak trading times. This extra support is vital, but it can be a headache for your internal payroll team. Payroll is complicated at the best of times. It must be done on time and you as the employer are responsible for the mistakes. So, this guide sets out some advice for seasonal businesses looking to stay organised and compliant when hiring.

First, before putting anyone on the payroll they must have*:

- Full name

- Address

- Date of Birth

- NI number

* If you’re hiring seasonal workers from outside the UK, you will need to meet certain requirements and apply for permission first. The requirements are different for each visa. For more guidance on hiring outside the UK after leaving the EU, follow this gov.uk link.

All casual workers need to be on the payroll

If you hire casual workers directly (i.e. not through an agency) they must be put on your payroll, no matter how short the employment period is – even if they work for a week or less.

Processing them through payroll includes managing deductions for income tax and National Insurance contributions. If they are paying Class 1 National Insurance contributions, they are also entitled to Statutory Sick Pay.

Weekly working maximums

Casual workers have the right not to work more than 48 hours a week on average. However, they also have the right to opt out of this if they choose to do so.

Do temporary workers need to join a pension scheme?

An employer can use a postponement period of 3 months, which will prevent short time workers having to be put into a company pension scheme, otherwise it is:

Any staff that are aged between 22 to State Pension Age and earn over £192 a week, or £833 a month, must be put into a pension scheme which you must pay into.

Holiday entitlement

Workers are entitled to a proportion of 5.6 weeks’ statutory holiday, which is calculated by how many hours they work. So, when taken at an hourly rate, all temporary, seasonal workers are entitled to 12.07% of the hours they have worked, as holiday pay.

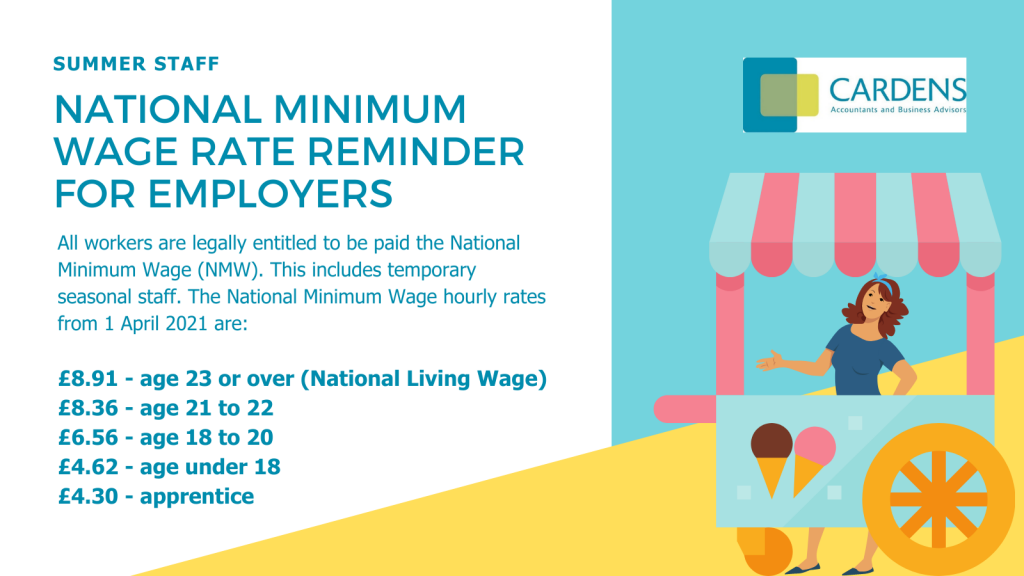

Wage rate reminder

All workers are legally entitled to be paid the National Minimum Wage (NMW). This includes temporary seasonal staff, who often work short-term contracts in bars, hotels, shops and warehouses over the summer.

The National Minimum Wage hourly rates from 1 April 2021 are:

- £8.91 – age 23 or over (National Living Wage)

- £8.36 – age 21 to 22

- £6.56 – age 18 to 20

- £4.62 – age under 18

- £4.30 – apprentice

Employers who do not pay the NMW can be publicly ‘named and shamed’ and those who blatantly fail to comply can face criminal prosecution.

Employers can contact the Acas helpline for free help and advice or visit GOV.UK to find out more.

Count On Cardens’ Payroll team

We run payrolls on time and can provide a tailor made service for your business including…

- Employee payslips

- Monthly summaries

- Departmental reports

- Dealing with leavers and starters

- Provision of analysis of staff costs

- Real Time Information (RTI) PAYE returns for the Revenue

- Assistance with automated payment set-up to your employees

- CIS returns completed by us

To find out more, please request a free consultation here, email us at or call 01273 739592

- Advice provided by Payroll Manager Angie King